How Animals Risk Security (LRP) Insurance Can Protect Your Animals Investment

In the world of livestock investments, mitigating threats is critical to making certain monetary stability and development. Livestock Threat Protection (LRP) insurance policy stands as a reputable guard against the unforeseeable nature of the marketplace, offering a calculated strategy to protecting your properties. By diving into the complexities of LRP insurance coverage and its complex benefits, animals producers can strengthen their financial investments with a layer of security that transcends market changes. As we check out the world of LRP insurance policy, its role in securing livestock investments ends up being progressively evident, assuring a course in the direction of sustainable financial strength in an unstable sector.

Recognizing Animals Danger Protection (LRP) Insurance Policy

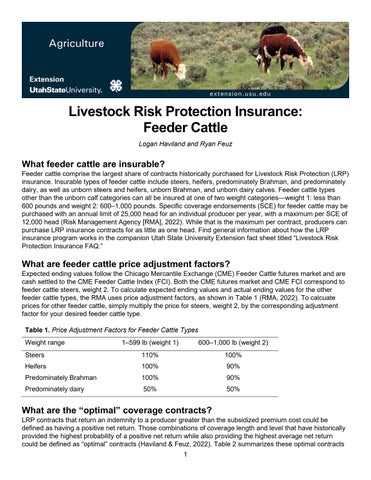

Comprehending Livestock Danger Protection (LRP) Insurance policy is vital for livestock manufacturers looking to minimize monetary threats linked with rate variations. LRP is a federally subsidized insurance coverage item made to secure producers against a decline in market value. By supplying protection for market price decreases, LRP helps producers lock in a floor rate for their livestock, making sure a minimal level of profits despite market changes.

One trick aspect of LRP is its versatility, allowing producers to tailor coverage levels and policy sizes to suit their particular demands. Manufacturers can choose the number of head, weight array, insurance coverage rate, and coverage period that line up with their manufacturing objectives and risk tolerance. Comprehending these personalized options is vital for manufacturers to effectively manage their cost danger direct exposure.

In Addition, LRP is available for various livestock types, including cattle, swine, and lamb, making it a functional threat monitoring device for animals manufacturers throughout various sectors. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make educated decisions to protect their investments and make sure monetary security when faced with market unpredictabilities

Benefits of LRP Insurance Coverage for Livestock Producers

Livestock manufacturers leveraging Livestock Risk Protection (LRP) Insurance acquire a tactical advantage in protecting their investments from price volatility and securing a stable economic ground in the middle of market uncertainties. One essential benefit of LRP Insurance is rate defense. By setting a floor on the rate of their animals, producers can reduce the risk of substantial economic losses in case of market slumps. This allows them to plan their spending plans better and make notified decisions concerning their operations without the constant anxiety of cost fluctuations.

Furthermore, LRP Insurance coverage offers producers with peace of mind. On the whole, the advantages of LRP Insurance policy for livestock producers are substantial, offering a beneficial device for handling risk and ensuring economic protection in an unforeseeable market environment.

How LRP Insurance Mitigates Market Threats

Minimizing market dangers, Livestock Risk Defense (LRP) Insurance coverage provides animals producers with a reliable guard against cost volatility and financial unpredictabilities. By offering defense against unforeseen price decreases, LRP Insurance assists manufacturers secure their financial investments and maintain monetary security in the face of market fluctuations. This kind of insurance policy allows animals manufacturers to secure a cost for their pets at the beginning of the policy duration, guaranteeing a minimal rate level no matter market adjustments.

Actions to Protect Your Livestock Investment With LRP

In the realm of farming risk management, carrying out Animals Threat Protection (LRP) Insurance coverage includes a critical procedure to safeguard investments against market fluctuations and uncertainties. To secure your animals investment efficiently with LRP, the very first action is to examine the details threats your procedure encounters, such as rate volatility or unanticipated climate occasions. Next off, it is critical to study and pick a reliable insurance coverage company that uses LRP policies tailored to your livestock and business demands.

Long-Term Financial Security With LRP Insurance Policy

Making certain sustaining monetary stability through the application of Animals Danger Protection (LRP) Insurance is a sensible long-lasting technique for agricultural manufacturers. By integrating LRP Insurance coverage into their threat administration plans, farmers can safeguard blog here their animals investments against unpredicted market changes and unfavorable events that can endanger their economic wellness gradually.

One secret advantage of LRP Insurance coverage for lasting economic protection is the tranquility of mind it supplies. With a trustworthy insurance coverage in position, farmers can mitigate the economic threats connected with volatile market conditions and unexpected losses as a result of factors such as disease episodes or natural calamities - Bagley Risk Management. This stability permits manufacturers to focus on the everyday operations of their animals company without continuous stress over possible monetary troubles

Additionally, LRP Insurance policy gives a structured strategy to managing danger over the long-term. By setting certain coverage degrees and picking suitable recommendation durations, farmers can tailor their insurance coverage prepares to straighten with their economic goals and risk tolerance, guaranteeing a lasting and safe and secure future for their animals operations. In final thought, purchasing LRP Insurance policy is an aggressive approach for agricultural manufacturers to achieve lasting economic protection and safeguard their incomes.

Conclusion

In verdict, Livestock Threat Protection (LRP) Insurance coverage is an important tool for animals manufacturers to mitigate market dangers and safeguard their investments. It is a sensible option for safeguarding livestock financial investments.